- Key Amendments brought by The Finance (Miscellaneous Provisions) Act 2020

Key Amendments brought by The Finance (Miscellaneous Provisions) Act 2020

Post the presentation of the National Budget 2020/2021 on 04 June 2020, entitled ‘Our New Normal: The Economy of Life’, The Finance (Miscellaneous Provisions) Act 2020 (the Act) was promulgated on 07 August 2020. The Hon. Minister of Finance of the Republic of Mauritius has announced a number of measures to ensure economic resilience and sustainable development subsequent to the economic situation brought by Covid-19. This alert highlights the key regulatory and fiscal amendments brought in the Act together with the date of effectiveness.

Financial Services Act

- The functions of Financial Services Commission Mauritius (‘FSC’ or ‘the Commission’) has been extended to include the following:

-

- The Commission may request competent authorities or any other entity (which includes Ultimate and intermediate financial holding Mauritian companies which have, within the group, at least one subsidiary or joint venture or such ownership structure which holds a licence by the Commission) to furnish to the Commission with the necessary statistical information within such time frame as may be prescribed by the Commission; and

- The Commission shall consult and with the approval of the competent authorities, collect the required information from the relevant entities, where the information requested under the above is not furnished within the time frame determined by the Commission.

- The following new business activities have been introduced under the Financial Services Act:

1. Moneylender

- A ‘moneylender’ is a person, other than a bank or a non-bank deposit taking institution, whose business is that of moneylending or who provides, advertises or holds himself out in any way as providing that business, whether or not he possesses or owns property or money derived from sources other than the lending of money, and whether or not he carries on the business as a principal or as an agent.

- This licence shall be provided by the Commission only to a corporate entity engaged in such business activities in Mauritius.

- Each moneylender shall comply with the prudential requirements, guidelines, instructions or directives as specified by the Commission.

- As part of its regulatory duties, FSC Mauritius may appoint a duly qualified person or an officer to carry out inspections on the operations and affairs of the moneylender to ensure that the moneylender is complying with the financial services laws and guidelines.

- Any person who contravenes the laws pertaining to moneylenders under the Financial Services Act shall commit an offence and shall be liable to a fine not exceeding one million rupees and to imprisonment for a term not exceeding 5 years.

2. Peer-to-Peer Lending

- “Peer-to-Peer Lending” is defined as a financial business activity which enables a person to lend funds through an online portal or electronic platform which matches lenders and borrowers.

Henceforth, a licensee who intends to surrender his license to the Commission, he must abide by the following:

- Give notice to the Commission of the proposed surrender date on not less than 30 days before the date of the proposed surrender;

- Make arrangements for the transfer of its business to another licensee prior to giving notice;

- After the date of surrender, the licensee must certify to the Commission that all his client accounts have been transferred;

- Provide the Commission with a written undertaking by the transferee that the business has been transferred to it;

- With respect to the discharge of his liabilities, the licensee must specify the measures taken by him;

- The effective date of termination must be specified; and

- The licensee must comply with other matters as required by the guidelines.

With respect to the reporting obligations of FSC’s licensees, the Commission may extend the period of filing the licensee’s Annual Financial Statements (AFS) during an emergency period. ‘Emergency period’ is defined as:

- A period of public emergency (as referred in Chapter II of the Constitution);

- A period during which a curfew order is placed or similar restriction on the movement of persons; or

- A period where Mauritius has been affected by a natural disaster.

A person or any class of persons required to file it’s AFS, may be exempted if the Commission is of the opinion that it would not be practicable for that person or class of persons to comply with this obligation.

Companies Act

An independent director is defined as an executive director with the following characteristics:

- He must not be an employee of the company;

- He must not have material business relationship with the company either directly or as a partner, shareholder, director or senior employee of an organisation that has such relationship with the company;

- He must not receive remuneration from the company except remuneration or any other benefit given to him as a director in accordance with the Companies Act;

- He must not be a nominated director representing a substantial shareholder;

- He must not have close family ties with any of the advisers, directors or senior employees of the company;

- He must not have cross directorships or significant link with other directors through involvement in other companies or other organisations; or

- He must not have been on the Board for more than 9 continuous years from the date of his first election.

As from 01 January 2021, the Board of directors of a public company shall include at least 2 independent directors.

With respect to the duties of directors to act in good faith and in best interests of the company, the director must act in a manner which is not, oppressive, unfairly discriminatory, or unfairly prejudicial to shareholders. Any director who fails to act in good faith under the Companies Act, he shall commit an offence and shall, on conviction, be liable to a fine not exceeding 100,000 rupees and to imprisonment for a term not exceeding 12 months.

Henceforth, Registrar shall give notice in the Gazette and by any electronic means prior to restoring any company in their register instead of giving public notice in 2 daily newspapers.

(Effective date: 07 August 2020)

Immigration Act

- In order to obtain a Resident Permit in Mauritius, the minimum investment has been reduced from USD 500,000 to USD 375,000.

- The Mauritius Permanent Residence Permit, which allows an eligible non-citizen of Mauritius to live and work in Mauritius, has been extended from 10 to 20 years.

- Any person who holds an Occupation Permit or Residence Permit for at least 3 years before 1 September 2020 may apply for a Permanent Residency Status upon satisfaction of criteria in Part III of the first Schedule of the Economic Board Act 2017.

- For an investor or a self-employed non-citizen, Occupation Permits issued for a period of 3 years and which is still valid as at 01 September 2020, shall be extended for a period of 10 years as from the date of the issue of the permit.

- Holders of an Occupation Permit as professionals or Residence Permit as a retired non-citizen may invest in any business given that he is not employed in the business, does not manage the business and does not derive any salary or employment benefits from the business. The holder may hold shares in a business where he/she is employed provided that he/she is not a majority shareholder.

- Any Occupation Permit holder will be allowed to bring their parents to live in Mauritius.

(Effective date: 02 September 2020)

CORPORATE TAX

Tax incentives

- Where, in an income year, a person has incurred capital expenditure on electronic, high precision or automated machinery or equipment on or after 1 July 2020, he shall be allowed, in that income year, a deduction of that capital expenditure, provided no annual allowance has been claimed.(Effective date: Year of assessment commencing 1 July 2021)

- Where, in an income year, a person engaged in medical research and development incurs expenditure on medical research and development, he may deduct from his gross income twice the amount of that expenditure in that income year provided the research and development is carried out in Mauritius. No further deduction can be claimed as annual allowance.(Effective date: Year of assessment commencing 1 July 2021)

- Where, in an income year, a company incurs expenditure for the acquisition of patents and franchises and costs to comply with international quality standards and norms it may deduct, from its gross income, twice the amount of such expenditure incurred in that income year. No further deduction can be claimed as annual allowance.(Effective date: Year of assessment commencing 1 July 2021)

- Where, during the period 1 July 2020 to 30 June 2023, a manufacturing company incurs capital expenditure on new plant and machinery, it shall be allowed, in the year of acquisition and in each of the 2 subsequent income years, a tax credit of an amount equal to 15% of the cost of the new plant and machinery.(Effective date: 07 August 2020)

Tax Holidays

- Income derived from inland aquaculture in Mauritius, by a company which has started its operations on or after 4 June 2020, for a period of 8 successive income years starting from the income year in which the company has started its operations.(Effective date: 07 August 2020)

- Income derived by a company which has started its operations in Mauritius on or after 4 June 2020 and approved by the Higher Education Commission as being a branch campus of an institution which ranks among the first 500 tertiary institutions worldwide whose ranking at the time of registration, for a period of 8 successive income years starting from the income year in which the institution has started its operations.(Effective date: 07 August 2020)

- Income derived from the manufacturing of nutraceutical products by a company which has started its operations on or after 4 June 2020 for a period of 8 successive income years starting from the income year in which the company has started its operations.(Effective date: 07 August 2020)

Additional investment allowance to companies affected by COVID-19

Where a company has, during the period 1 March 2020 to 30 June 2020, incurred capital expenditure on the acquisition of new plant and machinery (excluding motor cars), it shall, in addition to annual allowance claimed on the asset, be allowed a deduction of 100% of the capital expenditure so incurred by way of investment allowance in respect of the income year in which the expenditure is incurred.(Effective date: 07 August 2020)

Solidarity Levy on telephony service providers

The levy under shall be calculated at the rate of 5% of the accounting profit and 1.5% of the turnover of the operator in respect of the year of assessment commencing on 1 July 2020 and will be made permanent.(Effective date: Year of assessment commencing 01 July 2020)

Life insurance companies

Tax payable by a company deriving income from life insurance business, shall be the normal tax payable; or 10 per cent of the relevant profit whichever is the higher. The ‘relevant profit’ means profit after tax and after adjusting capital gain/loss.(Effective date: Year of assessment commencing 01 July 2021)

Extension of time for payment of corporate income tax for companies operating in the tourism industry

Any company engaged in an activity in the tourism industry having an accounting period ending on any date during the period September 2019 to June 2020 will be granted an extension to pay the tax as follows:

a. half of the tax on or before 29 December 2020; and

b. the remainder on or before 28 June 2021.

Any tax payable by the above named companies under APS which falls during the calendar year 2020, shall pay tax as per the extended delay specified above.(Effective date: 07 August 2020)

PERSONAL TAX

Solidarity Levy

- A tax resident individual shall be subject to Solidarity Levy at the rate of 25% of his leviable income in excess of MUR 3 million.

- However, the solidarity payable by an individual in an income year shall not exceed 10% of the sum of his net income excluding the lump sum but including dividends received from resident companies or co-operative society and share of dividends in a resident societe or succession to which he would have been entitled as an associate of a societe or heir in a succession.(Effective date: Income year commencing 01 July 2020)

Pay As You Earn

Where the emoluments under the PAYE system exceeds MUR 230,769 in a month, the employer shall withhold an additional tax on the amount exceeding MUR 230,769 at the rate of 25%, provided that the additional tax withheld does not exceed 10% of total emoluments.(Effective date: 01 July 2020)

Deduction for bedridden dependent

- Where, in an income year, a person claims a bedridden next of kin as a dependent, no other person shall claim that bedridden next of kin as a dependent in that income year.

- “Bedridden next of kin”, in respect of a person, means the bedridden father, mother, grandfather, grandmother, brother or sister of that person or of his spouse provided that the bedridden next of kin is eligible to the carer’s allowance payable under the National Pensions Act and under the care of that person.(Effective date: 01 July 2020)

Contribution Sociale Generalisee (CSG)

- Every participant and every employer of a participant, as applicable, shall pay the CSG to the Director-General at such rate as may be prescribed and in such manner, and at such times, as may be prescribed.

- The rate of the CSG for an employee shall be in respect of such remuneration as may be prescribed.

- “participant” means –

- an employee of such category as may be prescribed;

- a self-employed of such category as may be prescribed; or

- a person of such category as may be prescribed

who is liable to pay the CSG

- The employer of a participant shall, at the time of paying to the participant his remuneration for any period, deduct from the remuneration of the participant the CSG and remit that CSG to the Director-General.

- Every employer shall, in respect of CSG paid, submit an annual return or monthly return, as the case may be, in such form and manner, and at such times, as may be prescribed.

- The CSG shall be payable in respect of the month of September 2020 and for every subsequent month.

- Any CSG, including any penalty and interest, collected by the Director-General shall be credited to the Consolidated Fund.

- No contribution shall be payable to the National Pension Fund after 31 August 2020.

- Where an employer fails to pay to the Director-General the whole or part of any CSG, he shall be liable to pay to the Director General –

- a. Penalty of 10% of any CSG remaining unpaid; and

- b. Interest at the rate of 1% per month or part of the month during which the CSG remains unpaid.(Effective: 01 September 2020)

Assessments on employers and participants

- Where the Director-General has reason to believe that an employer or a participant has not paid the appropriate amount of CSG, he may claim the amount of CSG due by giving the employer or the participant written notice of assessment

- Where an assessment is made, the amount of CSG claimed shall carry a penalty not exceeding a percentage to be prescribed of the amount of additional CSG claimed.

- Where the Director-General has given notice of assessment, the employer or the participant, shall pay the CSG specified in the notice within 28 days of the date of the notice of assessment

- Where an employer or a participant is dissatisfied with a notice of assessment he may, within 28 days of the date of the notice of assessment, object to the assessment in a form approved by the Director General and sent to him by registered post or electronically.

(Effective: 01 September 2020)

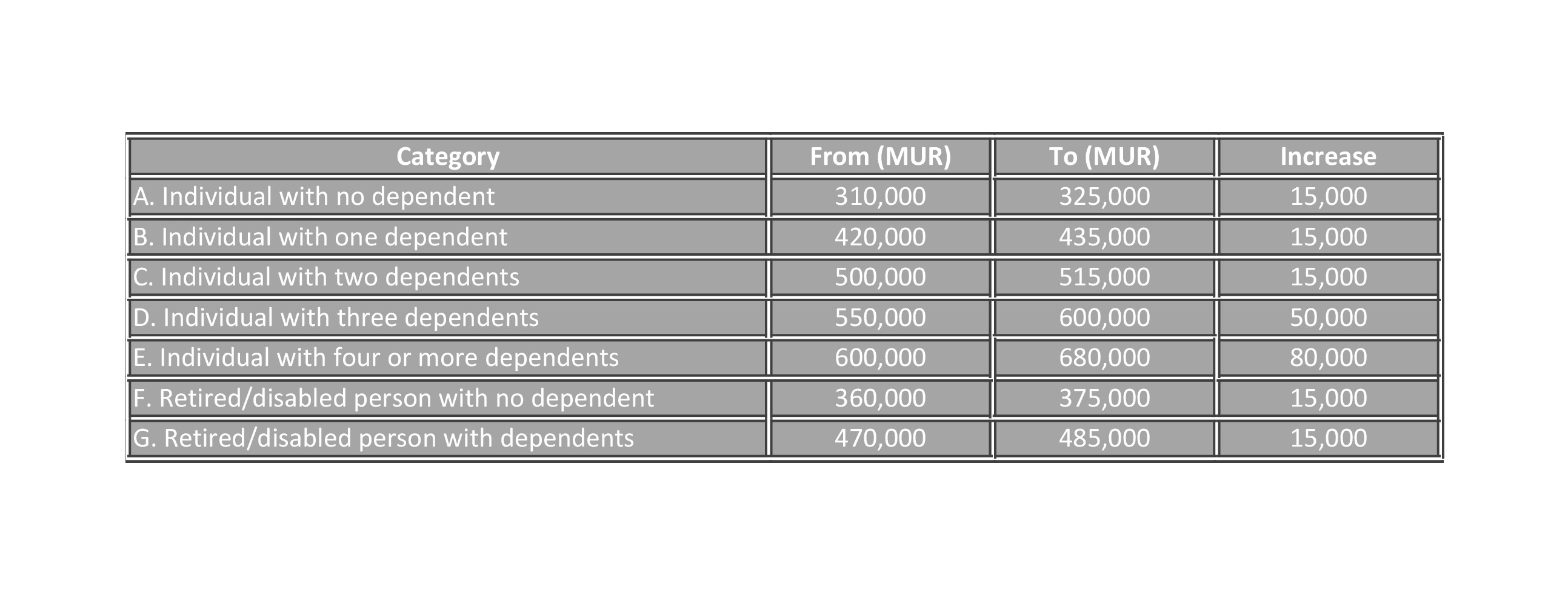

Income Exemption Threshold

Effective as from income year starting on 01 July 2020

VALUE ADDED TAX

VAT Registration

Application for VAT registration can now be done through CBRIS. (Effective date: 02 September 2020)

Construction Sector

- Where services are provided to a Ministry, Government department, local authority or the Rodrigues Regional Assembly under a construction works contract, the supply shall be deemed to take place at the time payment for that supply is received by the supplier.(Effective date: 01 October 2020)

- Claim for VAT refund of less than Rs25,000 on residential building now applicable in case of a final claim application or in case the amount of VAT incurred in a quarter and the preceding 3 quarters do not exceed Rs25,000.(Effective date: 01 February 2019)

VAT Exempt bodies extended to:

- Construction of a purpose built building and related infrastructure; and plant, machinery, equipment and materials (excluding vehicles), for any person engaged in medical R&D or a holder of a Smart and Innovative Mauritius Development Certificate issued by the Economic Development Board.

- Equipment (excluding office equipment, furniture and vehicles) for the exclusive use of an inland aquaculture project, as approved by the Ministry for any person engaged in Inland Aquaculture Scheme and registered with the Economic Development Board.

- Information technology system and information technology related materials and equipment, for the purpose of online education at the time of the setting up of the branch campus as approved by the Higher Education Commission established under the Higher Education Act and a branch campus of an institution ranked among the first 500 tertiary institutions worldwide.

(Effective date: 07 August 2020)

Digital and Electronic Services

- VAT shall be charged on any digital or electronic service supplied by a foreign supplier to a person in Mauritius, subject to such conditions as may be prescribed.

- Digital or electronic service means such service, which is supplied by a foreign supplier over the internet or an electronic network which is reliant on the internet or by a foreign supplier and is dependent on information technology for its supply.

- Foreign supplier means a person who has no permanent establishment in Mauritius/has his place of abode outside Mauritius and who supplies, in the course of his business, digital or electronic services to a person in Mauritius.

(Effective date: To be fixed by Proclamation Date)

OTHER VAT MEASURES

- The MRA shall capture non-monetary transactions by expanding the definition of value of the supply to include the open market value of the supply or such other amount as the Director General may determine. The supply is for a consideration not consisting, or not wholly consisting, of money or not made in the course of an arm’s length transaction. (Effective date: 07 August 2020)

- The VAT Act is being amended to include e-invoicing system to electronic fiscal devise. (Effective date: 07 August 2020)

- Where a registered person, having both exempt and taxable supplies, is engaged in a project spanning over several years the MRA may by notice require the registered person to apply an alternative basis of apportionment for input tax. (Effective date: 07 August 2020)

- Where an administrator, executor, receiver or liquidator is appointed to manage or wind up the business of any taxable person, the administrator, executor, receiver or liquidator, shall give notice of his appointment to the MRA within 15 days of the date of the appointment. (Effective date: 07 August 2020)

- Simplification brought to the reverse charge mechanism whereby it only applies when supply is made to VAT registered persons in Mauritius on services received from non-VAT registered person who does not belong in Mauritius. (Effective date: 07 August 2020)

TAX ADMINISTRATION

Where a claim for refund of excess income tax is made, the refund shall be made within a period of 60 days of the due date for the submission of the return or the date of receipt of the claim, whichever is the later. (Effective date: 01 September 2020)

Where an aggrieved person or his representative is absent at 2 consecutive sittings of the Assessment Review Committee to which he has been duly convened, the case shall be struck out unless the Chairperson is satisfied that the absences were due to illness or any other reasonable cause. (Effective date: 07 August 2020)

Any relevant documents required to be served on, or given to any person by the MRA, can be transmitted electronically, by post or delivered personally. (Effective date: 01 December 2020)

Every person who is required to submit a return or statement under any Revenue Law shall be allocated an e-tax account by the MRA. (Effective date: 01 December 2020)

The MRA may approve or set up such system for secure electronic service of notices/documents and payment of taxes. (Effective date: 01 December 2020)

Electronic submission of the following returns will now be mandatory (Effective date: 07 August 2020):

- Advance Payment System (APS)

- Current Payment System (CPS)

- Amended returns by any person

- Return for Trusts, Resident Societes, and for estate of a deceased person.